Market Analysis Review

July Core PCE Price Index up +0.2%, USDJPY +0.82% (+119.4 pips), CHF Retail Sales MoM forecast: -0.1%

Previous Trading Day’s Events (30.08.2024)

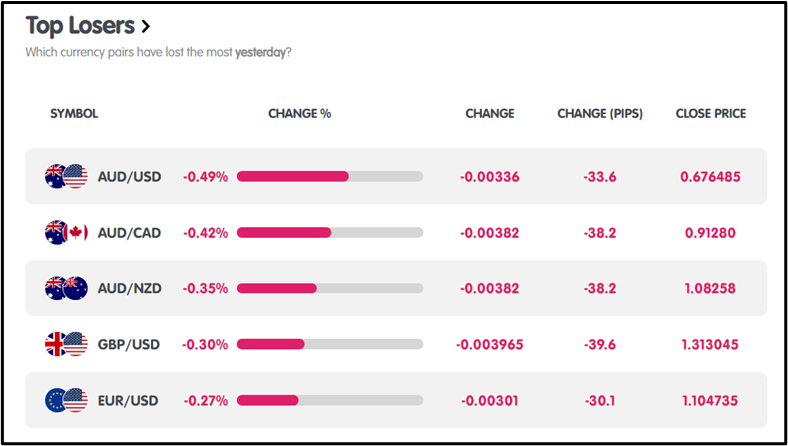

Australia Retail Sales: July retail sales flat, missing the 0.3% forecast. Household goods and other retailing unchanged; food up 0.2%, clothing down -0.5%, cafes down for the third month.

Euro Area Inflation Rate: August inflation drops to 2.2%, aligning with ECB’s 2% target and marking the lowest increase since July 2021.

Canada Monthly GDP: July GDP flat; finance and retail gains offset by declines in construction and mining. June GDP revised to no growth.

US Core PCE Price Index: July core PCE up 0.2%, matching June’s increase and market expectations.

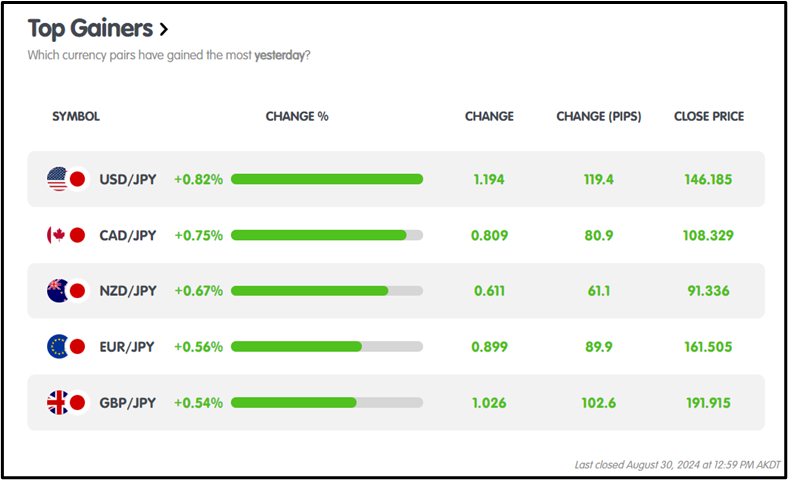

Winners Vs Losers In The Forex Market

On August 30, 2024, USDJPY led gains with a +0.82% move and 119.4 pips, while AUDUSD lagged, falling -0.49% and losing 33.6 pips in the forex market.

On August 30, 2024, USDJPY led gains with a +0.82% move and 119.4 pips, while AUDUSD lagged, falling -0.49% and losing 33.6 pips in the forex market.

News Reports Monitor – Previous Trading Day (30.08.2024)

Server Time / Timezone EEST (UTC+03:00)

Tokyo Session:

Tokyo Session:

Australia Retail Sales: Bearish AUD and flat July sales, missing the 0.3% forecast.

London Session:

Euro Area Inflation Rate: Bullish EUR; August inflation at 2.2%, aligning with ECB’s target.

New York Session:

Canada Monthly GDP: Bullish CAD; July GDP flat, offsetting sector declines.

US Core PCE Price Index: Bearish USD; July core PCE up 0.2%, in line with expectations.

General Verdict :

FOREX MARKET MONITOR

EURUSD (30.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EURUSD was bearish, opening at 1.10741 and closing at 1.10467, with a daily high of 1.10950 and a low of 1.10454.

CRYPTO MARKET MONITOR

CRYPTO MARKET MONITOR

BTCUSD (30.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD was bearish, opening at $59,589.89 and closing lower at $58,967.89, with a daily high of $59,968.79 and a low of $57,695.39.

STOCKS MARKET MONITOR

STOCKS MARKET MONITOR

NVIDIA (30.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Nvidia traded bearish, opening at $119.89 and closing lower at $119.41, with an intraday low of $117.20 and a high of $121.85.

INDICES MARKET MONITOR

INDICES MARKET MONITOR

US30 (30.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

The US30 maintained a bullish stance, opening at 41,411.66 and closing higher at 41,587.25, with intraday support at 41,160.37 and resistance at 41,611.63.

COMMODITIES MARKET MONITOR

COMMODITIES MARKET MONITOR

XAUUSD (30.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

XAUUSD traded bearish, opening at $2520.83 and closing at $2501.71, with a daily high of $2527.02 and a low of $2493.56.

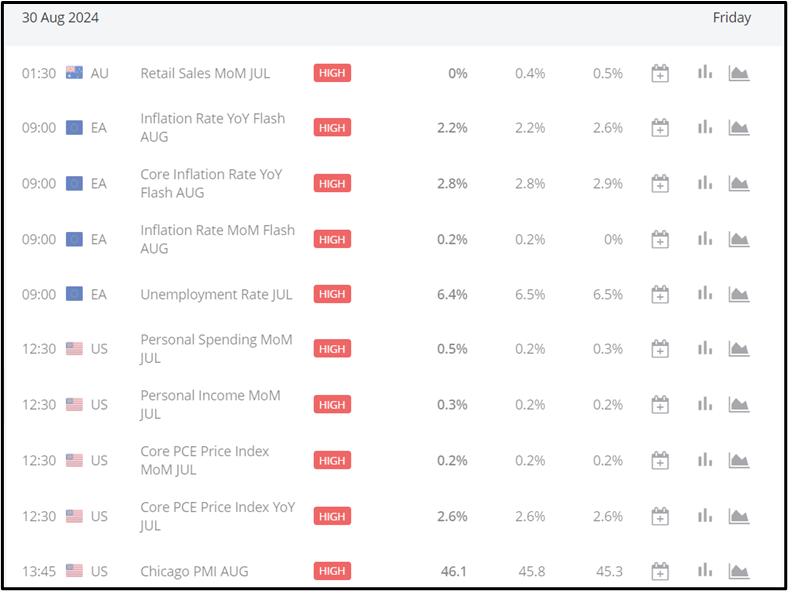

News Reports Monitor – Today Trading Day (02.09.2024)

News Reports Monitor – Today Trading Day (02.09.2024)

Tokyo Session:

Tokyo Session:

Bullish AUD after AU Building Permits MoM exceeded forecast ( Actual 10.4% vs Forecast 3.4%).

London Session:

CHF Retail Sales YoY forecast at -2.2% with a potential bullish CHF if higher.

CHF Retail Sales MoM forecast at -0.1% with a bearish CHF if lower.

New York Session:

No significant market-moving news.

General Verdict:

Sources:

https://ec.europa.eu/eurostat/

https://km.bdswiss.com/economic-calendar/

Metatrader 4 (MT4)