Market Analysis Review

Switzerland retail sales up 1.4%, AUDJPY gains 0.92% (+90.7 pips), US ISM PMI forecast at 47.5

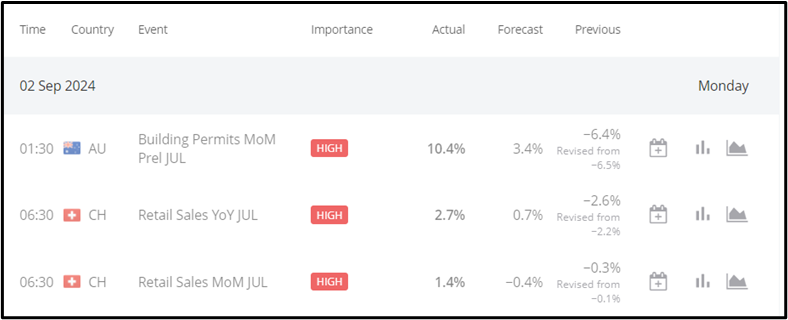

Previous Trading Day’s Events (02.09.2024)

- Australia Building Permits MoM: Building approvals surged 10.4% MoM in July 2024, hitting 14,797 units, driven by a 32.1% jump in private sector dwellings (excl. houses), easily beating a 2.5% forecast.

- Switzerland Retail Sales YoY: Swiss retail sales grew 2.7% YoY in July 2024, rebounding from a -2.6% drop in June, marking the strongest gain since February 2022.

- Switzerland Retail Sales MoM: Retail sales rose 1.4% MoM in July 2024, the highest in 13 months, beating expectations of a 0.2% drop..

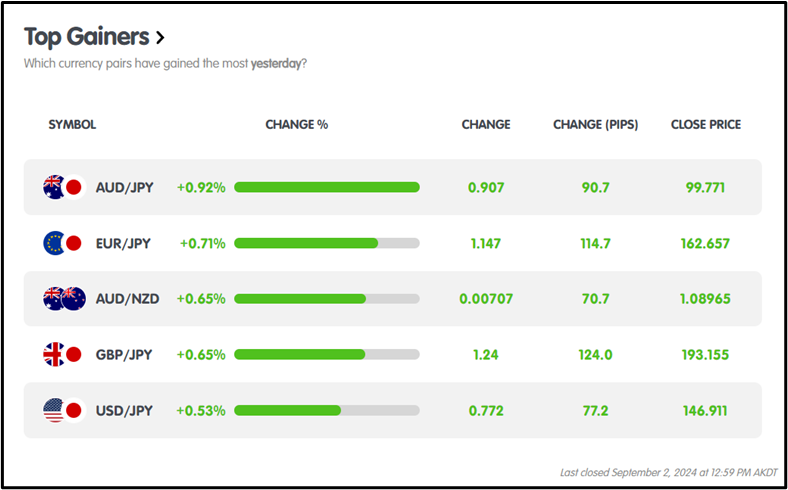

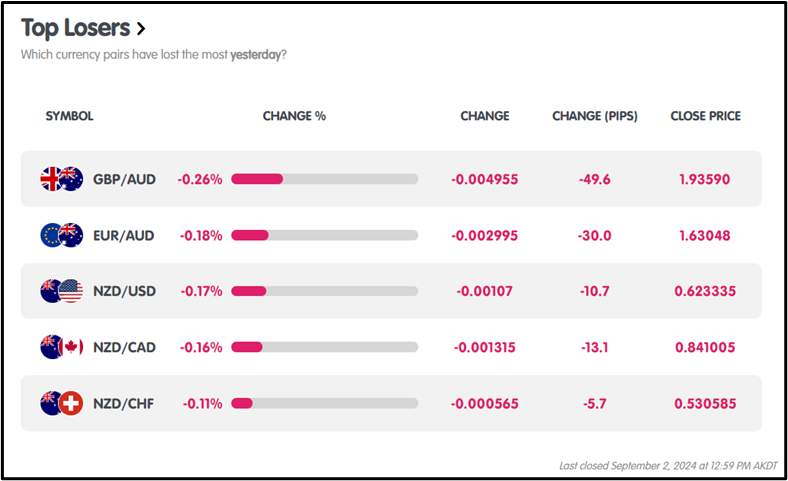

Winners Vs Losers In The Forex Market

On 02.09.2024, AUDJPY led the forex market with a +0.92% gain, adding 90.7 pips, while GBPAUD was the top loser, dropping -0.26% with a loss of 49.6 pips.

On 02.09.2024, AUDJPY led the forex market with a +0.92% gain, adding 90.7 pips, while GBPAUD was the top loser, dropping -0.26% with a loss of 49.6 pips.

News Reports Monitor – Previous Trading Day (02.09.2024)

Server Time / Timezone EEST (UTC+03:00)

1. Tokyo Session: Australia Building Permits MoM: AUD turned bearish post 1:30 AM GMT release; July 2024 approvals spiked 10.4% MoM.

2. London Session:

Switzerland Retail Sales YoY: CHF bullish on 6:30 AM GMT data; July 2024 sales up 2.7% YoY.

Switzerland Retail Sales MoM: CHF continued bullish after 6:30 AM GMT release; July 2024 retail sales climbed 1.4% MoM.

3. New York Session:

No significant data was released during this session.

General Verdict:

- AUD weakened following a strong rise in building permits, while CHF strengthened on positive retail sales data, with no notable data influencing the New York session.

FOREX MARKET MONITOR

EURUSD (02.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EURUSD exhibited an overall bullish trend, opening at 1.10435 and closing at 1.10713, with the intraday high reaching 1.10733 and the low at 1.10431.

CRYPTO MARKET MONITOR

CRYPTO MARKET MONITOR

BTCUSD (02.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD displayed an overall bullish trend, starting the session at $58,480.25 and closing at $59,021.54. The day’s price action saw a low of $57,045.84 and a high of $59,250.62.

INDICES MARKET MONITOR

INDICES MARKET MONITOR

NAS100 (02.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

The NAS100 showed an overall uptrend, starting the session at 19577.24 and finishing at 19616.48. The intraday peak reached 19616.54, while the trough was 19475.78.

COMMODITIES MARKET MONITOR

COMMODITIES MARKET MONITOR

USOIL (02.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

USOIL showed an overall bullish trend, opening at $72.827 and closing at $73.456, with an intraday low of $72.317 and a high of $73.813.

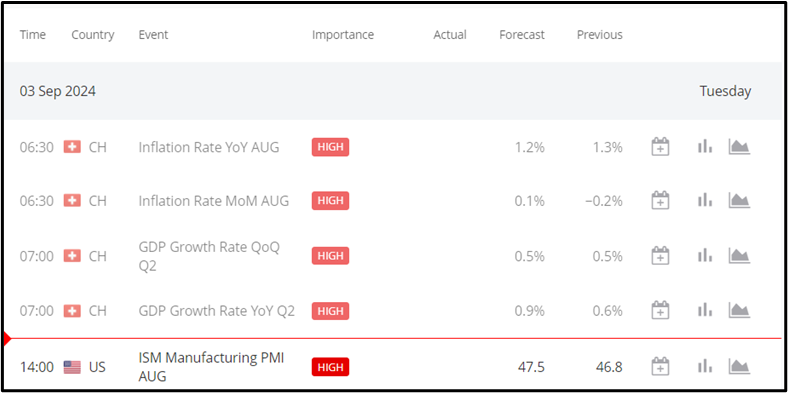

News Reports Monitor – Today Trading Day (03.09.2024)

News Reports Monitor – Today Trading Day (03.09.2024)

1. Tokyo Session

CH Inflation YoY (AUG): Forecast at 1.2%. An above-forecast reading may lead to CHF appreciation.

CH Inflation MoM (AUG): Forecast at 0.1%. A higher-than-expected figure could strengthen CHF.

2. London Session:

CH GDP Growth QoQ (Q2): Forecast at 0.5%. Exceeding this forecast may bolster CHF.

CH GDP Growth YoY (Q2): Forecast at 0.9%. A higher actual figure could further support CHF.

3. New York Session:

US ISM Manufacturing PMI (AUG): Forecast at 47.5. A stronger-than-expected reading could boost USD.

General Verdict:

- Key economic indicators across sessions suggest potential currency strength if actual figures surpass forecasts. Monitor CHF during the Tokyo and London sessions, and USD during the New York session for potential trading opportunities.

Source :

https://km.bdswiss.com/economic-calendar/

Metatrader 4 ( MT4 )