Technical Analysis Post

Daily Market Report: Expert Technical & Fundamental Insights – 07.11.2024

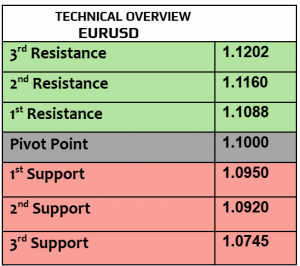

EURUSD

EURUSD is trying to recover from the heaviest daily loss in more than four years, trading higher today at $1.0748. USD index rallied yesterday after Trump strongly won the US presidential election, USD index traded at the highest in four months, approaching important technical resistance levels. Retail sales from EZ will be due later today. In the meantime, the markets are likely to remain busy with Trump’s victory, digesting the last comments from the newly elected president.

Technical correction started from the last support, still targeting $1.0780 then $1.0840. Momentum is slightly positive now.

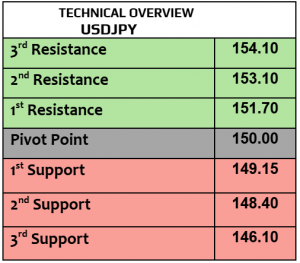

USDJPY

USDJPY fell today & traded at 153.98 after it gained more than 1.5% on Wednesday after both USD index & US bond yields rallied. Japan’s top currency diplomat said that they closely watch FX moves with high sense of urgency, in other words, BoJ may intervene in FX market if Yen’s excessive weakness persists. Japan’s labor cash earnings remained at 2.8% in September, unchanged from August. Japan’s household spending will be released later today.

Chart shows that the profit taking is targeting 153.50 then 152.80. Volatility is likely to remain elevated in this pair.

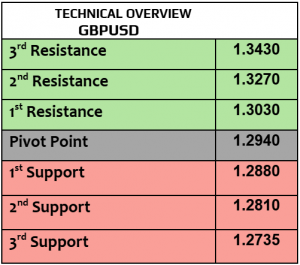

GBPUSD

Big Thursday from the UK with BoE rate decision & BoE’s governor press conference. GBPUSD started recovering after yesterday’s loss, trading higher today at $1.2937. Cutting the rates by -0.25% was already priced in & highly expected, that’s why the traders will keep an eye on Bailey’s comments and how BoE will deal with the UK government’s budget & deficit. BoE interest rate remained at 5%, the highest in more than 15 years.

Price action remained bullish, heading higher to $1.2995, then $1.3035. $1.2870 is support.

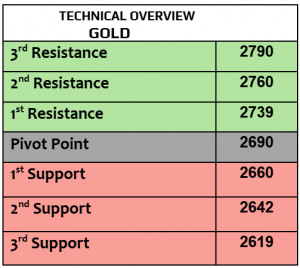

Gold

Gold fell by almost -3.5% since the beginning of November, gold was little changed today, trading at $2665 per ounce, the lowest in three weeks. Strength of USD & higher yields kept the pressure on gold while Trump’s proposed plans to tackle the inflation could weaken the demand for gold, however it is still early to position such a trade. Keep an eye on the Fed monetary statement later today as the rate cut by 0.25% was already priced in.

Traders started buying from support level $2650, targeting $2680 then $2710. Markets’ behavior is still showing bearish mode in the short-term.

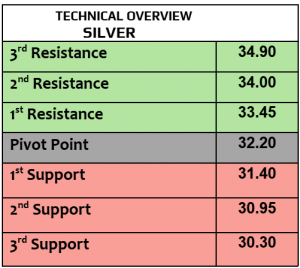

Silver

Silver was little changed today, trading at $31.15 per ounce after losing by more than 2% on Wednesday. While China’s exports increased in October, the imports declined by -2.3%, we will closely watch China’s inflation & PPI numbers on Saturday.

Momentum remains negative now. There is no change in traders’’ behavior that still targeting $31.50 as profit taking may happen. $30.90 is support with weaker volatility than gold.

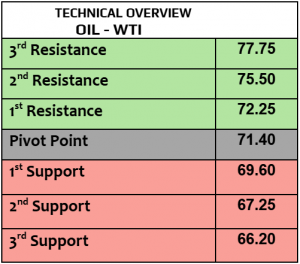

Oil – WTI

It is correct that Trump is planning to support the US oil industry, but the question is: will the prices go higher or lower? that’s what matters to the US consumers. In the meantime, US crude oil inventories increased by 2.1 million barrels last week according to EIA after it fell by 0.5 million barrels two weeks earlier. Crude oil prices were little changed today, WTI $71.66PB, Brent $74.95PB.

Price action remained mixed with 1H RSI is falling now & targeting $70. $72.50 is resistance, 1H trend index remained bearish with low volatility.

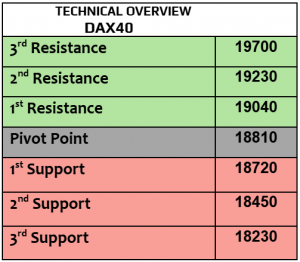

DAX

DAX index fell by more than -1% on Wednesday due to Trump’s proposed policies that include tariffs on EZ products & exports. DAX traded higher today at 19103. Germany’s service PMI improved in October, while the industrial production fell by -2.5% in September, worse than the estimates. Auto sector was among the hardest hit yesterday with VW -6%, Porsche -5% and Mercedes dropped by -6.7% as well, auto stocks could be exposed to serious risks because of the US tariffs (if any).

Price action is improving, heading higher to 19170 then 19300. 1900 is support (1H chart).

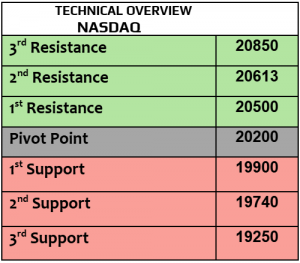

Nasdaq

US stock futures continued the strong performance today & traded higher after yesterday’s rally, Dow Jones 3.7%, SPX 2.5% & Nasdaq 2.9% with Trump’s massive victory over Harris in the US presidential election. Trump announced before that he will reduce the tax on the US corporations, supporting the oil industry & protect the US manufacturing. Federal Reserve rate decision later today was already priced in, what matters is Powell’s comments mainly after Trump’s victory.

Totally overbought, but the price action remained highly bullish. 20500 is support, with high volatility index (4H chart) and bullish trend ( daily ).

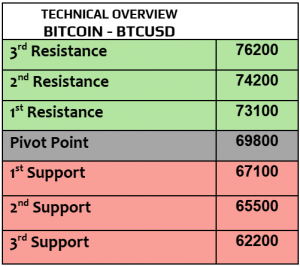

BTCUSD

After the rally on Wednesday, BTC traded slightly weaker today at $74900, Eth is still up by 4% at $2825, Solana $188 and Ripple advanced by 2.4% to $0.5560. One major event was the only catalyst in yesterday’s rally which was Trump’s unbeatable victory. US spot BTC-ETFs rebound with $622 million inflows, breaking three day losing streak. Trump was one of the main crypto supporters in the last months.

Technically speaking, 1H chart index is bullish, still aiming higher to $75900 then $76200. $73500 is support then $71K.