Technical Analysis Post

Daily Market Report: Expert Technical & Fundamental Insights – 08.11.2024

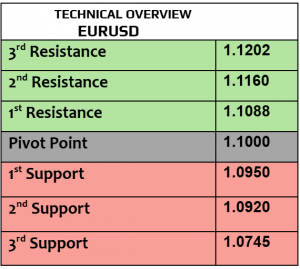

EURUSD

EURUSD traded slightly lower today after it gained by almost 1% yesterday, trading at $1.0784. As USD index gained momentum after Trump’s victory, the correction happened yesterday, however maintaining the bullish performance in EUR lacks stronger fundamentals from EZ. EU leaders’ summit will be held later today.

Technical correction started from the last support, still targeting $1.0780 (executed) then $1.0840. Momentum is slightly positive now. $1.0745, $1.0715 and $1.0685 are support levels for day-traders.

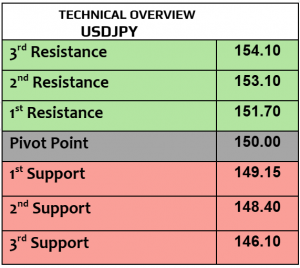

USDJPY

As the US bond yields remained elevated, correction in USDJPY was somehow limited, trading today at 152.90. Japan’s leading economic indicator improved in September, and household spending contracted by -1.1%, but that was better than the previous estimates of -2.1% decline. Federal Reserve cut the rates by 0.25%, was highly expected & priced in, that’s why this currency pair showed no major change.

According to the trend index, bearish bias continued, however 1H price action shows slow bullish bets, targeting 153.20 then 153.75 as 1H RSI is not far from support level.

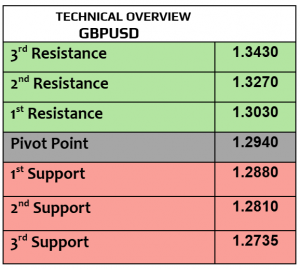

GBPUSD

GBPUSD was little changed today at $1.2970 after BoE cut the rates by -0.25%, matching the markets’ forecasts. According to BoE meeting, policy makers wanted gradual easing approach & emphasized the need for restrictive monetary policy, in other words BoE is unlikely to be in hurry to cut the rates further. BoE expected inflation to increase from 1.7% to 2.5% by the end of the year.

Price action remained bullish, heading higher to $1.2995, then $1.3035. $1.29 & $1.2870 are support levels for speculators.

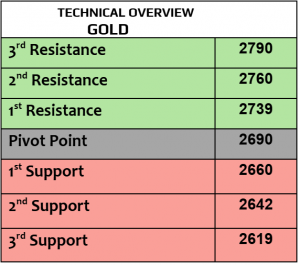

Gold

Gold is still down by -1.5% in a week, was able to gain by almost 1% yesterday and traded weaker again today at $2695 per ounce. According to the Fed, the inflation is moving closer to the central bank’s target of 2%, but it remained sticky. The focus will remain on US bond yields & mid-term outlook of the US inflation. China’s easing measures matter as well.

$2650 is an important support (1H chart), with bullish bias. Price action is mixed now, still targeting $2710 but market’s bears remained strong as well.

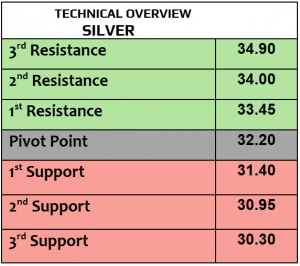

Silver

Silver fell today by -1%, trading at 31.69 per ounce, losing more than -2% in a week, still up by 34% YTD. Cutting the rates by the Fed was not a big surprise, but the investors could become more anxious about China’s easing measures, what if China’s government disappoints the traders! In the meantime, if Trump becomes able to strengthen the economy & support the US manufacturing then silver is likely to benefit as well, America consumes around one fifth of global silver then China & Japan.

Momentum remains negative now. There is no change in traders’ behavior, still targeting $31.50. $30.90 is support (short-term)

.

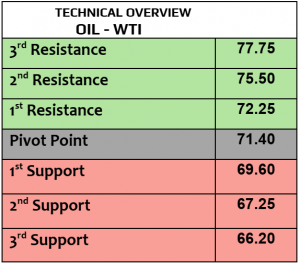

Oil – WTI

Crude oil prices fell today, WTI $71.81PB, Brent $75.20PB, both crude oil benchmarks remained up by 3% in a week. While there was no major event in oil market, everyone is asking, what will Trump do to the US oil industry? Trump always showed his full support to American oil industry, pushing for more oil production, so if that happens then oil prices could fall further.

1H RSI is sideways now, $72.60 is resistance, $70 is support. Volatility remained low & 1H trend index is bullish now.

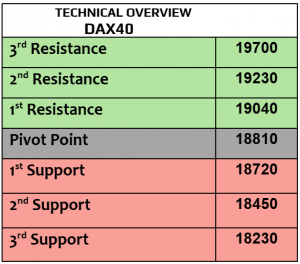

DAX

DAX futures traded higher today at 19400 after the rally by 1.7% yesterday, following the same bullish trend of US equities. Political instability in Germany intensified after Chancellor Olaf dismissed his finance minister which means ending the current government coalition. In the meantime, SAP gained 3.5%, Siemens 2.1% and auto sector recovered yesterday, Mercedes 2.8%, Porsche 4% and BMW 2.9%.

Our bullish view was totally accurate, executing our target at 19300. 1H RSI is approaching from overbought level, but markets’ sentiments still support further advance to 19550 (resistance), 19200 is support.

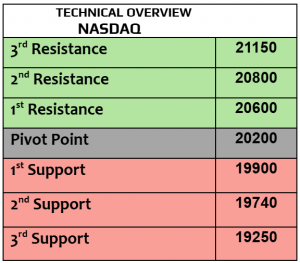

Nasdaq

US stock futures traded slightly higher today with three consecutive daily gains, and new record highs as well. US stocks have been supported by three major factors recently, strong US corporate earnings in Q3, reducing the rates by the Fed & the most was Trump’s landslide victory. Unit labor cost in the US increased by 1.9% in Q3, it shows cost of employing a labor, which means the cost & inflation. US initial jobless claims remained unchanged in the last week by 221K. University of Michigan consumer sentiment index will be released later today.

Totally overbought, but the price action remained highly bullish. 20800 is support, with high volatility index (4H chart) and bullish trend (daily).

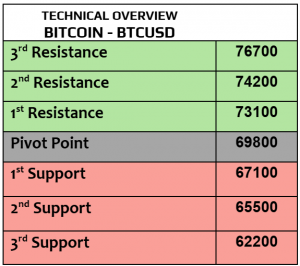

BTCUSD

Bitcoin traded unchanged today at $76013, record-high, Eth $2920, Ripple $0.5506 and Solana $199.25., with Bitcoin showed no overheated signs despite new record highs. As crypto assets remained highly speculative, volatility is likely to remain strong while crypto traders were eager to know what’s next after Trump’s massive victory, Trump still supports crypto assets which may lead to de-regulations in the US, that’s gonna be (if happens) the best scenario for crypto market & traders.

$76700 is a new resistance, $74700 is support. Daily and hourly trend index is bullish.